Maine Insider Newsletter

April - May 2024

Spring market is coming! Flowers are blooming, but in lots of ways we are living with the echos of the last four years in our economy. This month we share some knowledge and opportunities which will hopefully allow you to have some control over how 2024 continues to play out for you!

Much Love,

Michael Hamilton

P.S. If you have pets, or are thinking of getting some, check out our article on the hidden gem Pets on Point in Portland!

📸 The Maine Shot

Snow is melting… a view of Mt Blue from Starks, Maine

Things to do:

March & april

April 20 (Saturday) - Open House 12pm - 2pm - 7 Arundel Drive, Lisbon

April 20 & 21 (Sat & Sun) - Open House 11am - 1pm - 29 Williams Drive, Topsham

April 20 (Saturday) - Opening Day - Portland Farmers' Market in Deering Oaks

April 20 & 21 - Maine Gem, Mineral & Jewelry Show

April 27 (Saturday) - I'm a Trustee...Now What? Real Estate Planning Seminar

May 8 (Wednesday) - Lyle Lovett & Lisa Loeb Perform

May 12 (Saturday) - Maker's Market at the Point

May 15 (Wednesday) - Southern Maine Successful Aging Expo

May 18 (Saturday) - Allspeed Bike Swap (Portland)

Market insider

with Michael Hamilton

This month, let's dive deep into some pressing issues in real estate, particularly focusing on national and local housing affordability challenges and what we, as individuals, can do to address it.

Lately, the headlines have been ablaze with news of the Department of Justice's crackdown on various real estate entities, including the National Association of Realtors (NAR), lending institutions, OPEN Door, and major brokerages. You might have seen phrases like "big savings for home buyers ahead" or "NAR lawsuit expected to lower home buying costs."

Honestly, these headlines have left me feeling frustrated. It's disheartening to see our industry under such scrutiny. I've taken a step back to understand why it bothers me so much. Is it the fear of tougher regulations making our job harder? Or the potential loss of income? Perhaps, but I think it's more about seeing something I'm passionate about being misrepresented in the media.

Upon reflection, I realized that my discomfort stems from a deeper concern: the distortion of information and the manipulation of emotions, which could ultimately harm my clients and friends. This month, I want to address these issues head-on and explore how we can navigate them together.

Let's start by unpacking a crucial distinction: the difference between the cost of buying a home and the cost of owning one.

Consider this startling statistic: median home prices soared from $329,000 in the first quarter of 2020 to a whopping $479,500 by the fourth quarter of 2022—a staggering 46% increase. It's a trend that's hard to ignore and demands our attention.

We'll delve into various factors contributing to the affordability crisis, from "junk fees" imposed by loan officers to discussions about cutting agent commissions to lower housing costs. We'll also examine the impact of home production trends over the past two decades and analyze the intricate interplay of inflation, interest rates, home values, and the true cost of homeownership.

Furthermore, recent events like the collapse of Chase Custom Homes, one of Maine's largest builders, and the potential repercussions of the NAR's uncertain future raise valid concerns about property rights and market stability.

But amidst the challenges, there's hope. We'll explore actionable steps that each of us can take to mitigate the rising costs of homeownership and foster a more equitable housing landscape.

During the same timeframe, the average interest rates fluctuated significantly: from 3.53% in Q1 2020 to a low of 2.76% in Q4 2020, then skyrocketing to 7.33% by Q4 2023.

Let's examine the cost of buying and owning a home at these different interest rate points, based on mortgage payments with principal and interest only, assuming a 5% down payment, and excluding taxes and insurance.

In Q1 2020, buying a home at the median price of $329,000 would result in a monthly payment of $1,407 at a 3.53% interest rate. By Q4 2020, with the median price rising to $359,000, the monthly payment decreased slightly to $1,394 at a 2.76% interest rate.

Here's where it gets interesting: while the price of buying a home increased by over 9% between Q1 2020 and Q4 2020, the monthly payment actually decreased by 1%. This discrepancy can potentially foster concerning habits among buyers.

Fast forward to Q4 2023, with the median home price now at $418,000 and a whopping 7.30% interest rate. The cost of buying a home has surged by 27% since Q1 2020, while the monthly payment has skyrocketed by a staggering 93%.

As you can see, homeowners are now facing a double whammy of price and payment increases. And the primary driver of this affordability crisis? Interest rates. Even if home prices remained constant at Q1 2020 levels, the average monthly payment would have still ballooned from $1,407 to $2,143—a 52% increase—solely due to rising interest rates.

So, if we want to make a meaningful impact on the cost of homeownership, the quickest and simplest solution is to bring those interest rates back down. It sounds straightforward, right? Well, not quite. We're grappling with a rather stubborn inflation problem.

To combat runaway inflation, the Federal Reserve has resorted to hiking interest rates—their most dependable tool. Back in August 2022, inflation peaked at a staggering 8%, prompting the Fed to take decisive action. As they raised rates, inflation gradually receded. It's a delicate dance between interest rates and inflation, as one rises to tame the other.

But is the inflation-induced interest rate hike solely to blame for the housing affordability conundrum? Is it as straightforward as lower rates leading to a surge in home purchases and subsequently higher prices? Conversely, do rate hikes flatten housing prices but perpetuate the rise in the cost of homeownership?

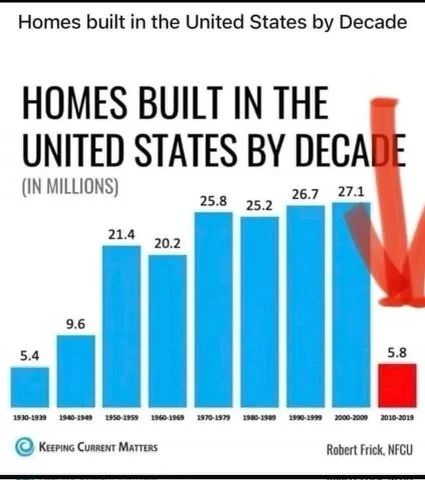

The reality is far more nuanced. Let's scratch the surface of this complex issue and introduce a crucial factor from the '90s: housing starts.

What a rollercoaster ride it's been! Does anyone else remember the tumultuous years of 2008-2009? It was a tough time for many, reminiscent of the wild ups and downs of the Beanie Baby craze. Remember that? Overnight, these little stuffed animals became the hottest commodity, with prices soaring into the tens of thousands for certain rare ones. The reason? Simple economics: supply and demand.

Now, let's circle back to our initial question: How do we solve the housing affordability crisis? Well, if I could hop in a time machine, I'd head straight back to 2008. Instead of just bailing out the big banks, I'd advocate for bailing out homeowners and builders too. Why? Because the fallout from the 2008 crash wasn't just felt by the big players—it decimated many small and mid-level builders, some of whom never recovered. And yet, what America needed most during those years was homes and builders to construct them.

Here's where we need to take action:

Call to action #1: We must champion sustainable and profitable home construction at all levels of government. The "not in my backyard" mentality poses a real challenge. If we want future generations to afford homeownership, we must support sustainable development now. And it's crucial that builders remain profitable, or they'll simply stop building for homeowners.

Maine, in particular, faces significant hurdles in this regard. The regulatory landscape makes it incredibly difficult to build, gain approvals, and garner local support. As a result, many builders have shifted focus to large-scale apartment projects they retain ownership of, further exacerbating the rental market's dominance. We need to rally behind local builders, encouraging them to invest in housing projects that promote homeownership.

Call to action #2: Fiscal responsibility is key. During the COVID era, many of us developed unsustainable spending habits, driving up economic heat and, eventually, credit card debt. As individuals, we must rein in spending, manage credit wisely, and strive to live with less. Lowering the economy's temperature is essential if we want the Fed to consider lowering interest rates, thereby easing housing costs.

Call to action #3: Become a critical and thorough researcher. Don't accept headlines at face value. Challenge yourself to dig deeper, question, and seek understanding. Lowering fees for realtors, loan officers, and title companies may provide marginal relief, but the real solutions lie in lowering interest rates and increasing housing supply. Hold politicians accountable on these fronts.

Call to action #4: Protect individual property ownership rights. With the NAR under Call to action #4: Protect individual property ownership rights. With the NAR under fire, the future of this vital organization hangs in the balance. More than half of realtor dues go toward lobbying efforts to safeguard property rights. If the NAR fades away, who will advocate for your property rights in legislative chambers?

We need more homes, we need to spend out money responsibly and we need politicians and news outlets questioned and held accountable to protect our futures. Are you doing what you can today?

Chris Foster is a REALTOR® with Home Sweet Maine - Keller Williams Realty and certified KW Real Estate Planner

Chris’s Corner

Planning for Your Future

Navigating the Trust and Probate PROCESS

Sarah Chong started the day with her usual routine of sipping her morning coffee and enjoying the ocean views from her porch. She unaware her life would soon change with a single phone call; Sarah’s beloved aunt, Mary, had passed away.

As the trustee of Mary’s estate, Sarah now faced the overwhelming responsibility of managing her aunt’s assets, including a picturesque oceanfront property in Cape Elizabeth. She was grieving and completely unprepared for the complexities of real estate in the trust and probate process.

Sarah’s story is unfortunately all too familiar.

Trusts and probate are essential aspects of estate planning that many people, especially mature adults, should be aware of. Planning for the future is essential, and creating a trust can help protect your assets and ensure a smooth transition for your loved ones.

This process can be daunting, however, especially when dealing with emotional stress and grief. This is where experienced an professional can help relieve some of the pressure on you.

I specialize in various real estate areas like trust and probate sales in Maine and provide a compassionate approach to the challenges families face during these difficult times.

In addition , the Home Sweet Maine Team provides guidance on complex real estate matters, such as 1031 exchanges and DST options, to help clients minimize or eliminate capital gains taxes and maximize their real estate investments. In addition, I have a network of service providers - from junk removal to estate attorneys - that I can connect you with.

I’d like to invite you to my upcoming seminar on “I’m a Trustee… Now What?” in Portland on April 27th at 11:30 at 50 Sewall Street, Portland (Keller Williams offices - 2nd floor in the education room). You can sign up here and share the event with others who may be also have questions about the duties of a trustee.

To learn more about how I can help you create a real estate plan to facilitate your family goals, call or text Chris at 207-417-4907 for a no-obligation strategy session.

Pets on Point - Portland

Hidden gems of maine

Contributed by Bethany Ward,

Director of Operations, Home Sweet Maine

Betta fish in chain pet stores

Recently, I decided to start a fish tank after 15 years of no fish. After visiting the usual chain pet stores, I was shocked at the quality of care the betta fish were receiving (you know, the fish that are colorful with long tails that we were told as kids could live in bowls and be healthy?). I decided not to give these chains my money.

Through the magic of Facebook, I happened upon a video of beautiful fish in a store in Portland - The Dog Wash, etc. at Pets on Point in Portland. I decided to to take a trip down.

What I found was a pet lover’s dream - self serve dog wash stations, high-quality dog and cat food, wholistic health supplements, wide selection of toys, and, most exciting for me, two walls of bettas in large holding tanks! These bettas were not the usual you see in chain stores - and their care and health were lightyears beyond what I was used to seeing at the usual stores.

I spoke with the owner, Mark Goodwin, about his bettas, his store, and the service he aims to provide the local community of Portland.

Mark (along with his brother) of Pets on Point, started the business 20 years ago as a self-serve dog wash, catering to apartment and condo dwellers without the space (or desire) to wash their dogs at home. Portland residents eagerly adopted this concept, and the dog wash soon had to move out of their 900 square foot space to a larger facility to accomodate demand. They have since moved to a 5500 square foot space on Forest Ave.

The mission of Pets on Point is to provide a safe place for pet owners with limited space at home to wash their dogs, and purchase pet supplies in one place. In their new location, they have several self-service dog washes to meet these needs, as well as local delivery when you purchase online (dog food delivered to my door? Yes, please!). Mark and his excellent staff work hard to establish trust with customers by providing excellent service and being informed of most aspects of pet care and health.

Owner Mark Goodwin, in front of his custom-designed betta tank system

The latest venture into selling betta fish is, again, to accomodate those with smaller living spaces (or offices) that would like a pet, but don’t have the space. The 60 one-gallon tanks were custom-designed by Mark to keep the water heated and circulated, and the fish healthy. Just looking at the tank design, you can tell he really cares about the fish.

The fish are stunning - a rainbow in a tank! The colors range from silver to red to multi-colored (so many colors it’s hard to put into words!). Some are spunky and demanding, some are shy, and some have the funniest grumpy face.

They stock all the betta supplies you could need - small nano tanks, heaters, food, decor, gravel, etc. - a one-stop-shop! You really don’t need anything else - Pets on Point has it all for your fish.

It is clear that Mark loves his fish, and takes pride in them, as much as he cares about connecting with the local community and providing them with top-tier pet supplies and services. If you would like to support a local business (and make your pets happy at the same time), I highly recommend making the trip to Pets on Point. And, if you’re thinking of buying a betta fish, Pets on Point is your place. I can speak from experience - my Pets on Point betta, Pepe, is doing great in his new home at my apartment :)

To find out more about Pets on Point, check out their website here, or Facebook page. If you are interested in bettas and proper care, you can join the Maine Betta Keepers Society Facebook group, started by Mark, the owner of Pets on Point.

Property Listings

Homes for Sale & local trends

Not signed up yet?

Don’t miss a newsletter - sign up below!